4th JUNE 2025

The Institute of Certified Public Accountants of Kenya (ICPAK) is the statutory body of Accountants established by the Accountants Act CAP 531.The Institute is also a member of the Pan Africa Federation of Accountants (PAFA) and the International Federation of Accountants (IFAC), the global umbrella body for the accountancy profession.As a member of IFAC, the Institute is mandated to comply with the requirements of the 7 Statements of Member Obligations in pursuit of developing and regulating the profession. One of the major challenges faced by the Institute is the presence of unqualified and unregistered individuals performing the work of accountants and auditors within the country. These fraudulent or unqualified individuals who pose as legitimate professionals may provide false financial advice, manipulate records, or engage in other deceptive practices, thereby tarnishing the credibility of the profession.

The Institute has been grappling with the challenge of making the accounting profession free from quacks. ICPAK has undertaken several initiatives in the past to mitigate risks and uphold integrity in practice. Such efforts include verifying credentials, performing due diligence, establishing clear engagement terms backed by documentation, conducting regular monitoring and review practices, fortifying internal controls at both the firm and engagement levels, educating stakeholders, and developing frameworks to facilitate the reporting of suspicious activities and whistleblowing on malpractices and potential issues of quacks.

Despite these efforts, most users of financial statements are still unable to determine whether the services they receive are from qualified Professional Accountants. The Institute intends to utilise technology to address this challenges through the creation of a platform for the verification of all work done by Practicing Members.

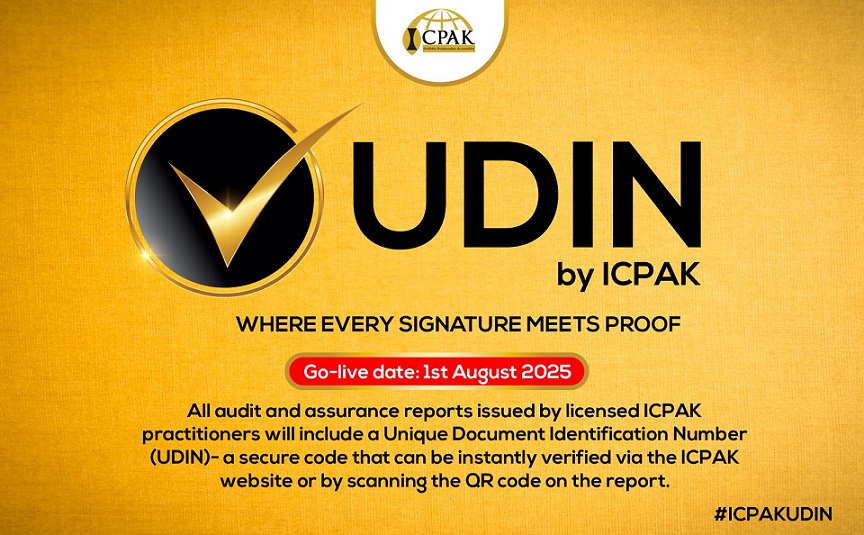

The Institute is proud to announce a significant milestone for its licensed practitioners that will enable the verification of all work completed through a unique serial number and code that can be verified from the ICPAK website. This initiative is called the Unique Document Identification Number (UDIN), which has been developed through a series of reviews and benchmarking with other successful jurisdictions worldwide. The Institute has organised a series of engagements with key stakeholders, regulators, and procuring institutions to ensure the uptake of this initiative in pursuit of public interest. By taking these proactive measures, the Institute will minimize the risks associated with quacks in accountancy and uphold the credibility and reliability of the profession while protecting the space occupied by its validly licensed practitioners.

As a licenced practitioner, you will be required to log into your practitioner portal, which will direct you to the UDIN portal. From here, you will follow the procedure to generate a unique QR Code and serial number that can be copied and pasted on the final document before it is issued to the client.

The Institute is currently piloting the platform and receiving feedback for further improvements ahead of the go-live date of 1st August 2025. To participate in the testing and provide feedback, or for further clarification on the platform, please contact us via udin@www5.icpak.com and ceo@www5.icpak.com or by phone at +254719074 000.